About This Blog

Sales tax is one of the most interesting, and challenging, taxes. It’s interesting because it involves clients in every possible industry. Every active business has potential sales tax exposure, no exceptions! And unfortunately sales tax compliance is particularly difficult for two, specific reasons. First, the tax is perhaps the most fact-dependent – seemingly inconsequential changes in the underlying facts can transform a nontaxable sale into a taxable one. Second, these rules are constantly changing. It’s tough enough to keep up with these changes in just one state. But many vendors, especially those selling over the internet, have to keep abreast of these changes in multiple states. So it’s easy to fall behind on sales tax compliance.

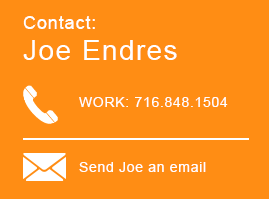

With this blog, we hope to keep you up to date on impactful changes in the sales tax compliance, especially in New York State. We’ll review legislative and administrative changes in the sales tax; we’ll discuss new sales tax case law; and we’ll highlight the enforcement initiatives and tactics we’re seeing while defending businesses in sales tax audits. We hope you find this content as interesting as we do. Please contact us with any questions.

Stay Connected

Topics

Joseph N. Endres

Joseph N. Endres

Showing 35 posts by Joseph N. Endres.

Sales Tax Cases from the TiNY Blog for April 16, 2024

Here are the sales tax cases from the TiNY Blog for the week of April 16, 2024.

Sales Tax Cases from the TiNY Blog for April 10, 2024

Here are the sales tax cases from the TiNY Blog for the week of April 10, 2024.

Sales Tax Cases from the TiNY Blog for March 26, 2024

Here are the sales tax cases from the TiNY Blog for the week of March 26, 2024.

Sales Tax Cases from the TiNY Blog for March 5, 2024

Here are the sales tax cases from the TiNY Blog for the week of March 5, 2024.

Sales Tax Cases from the TiNY Blog for February 12, 2024

Here are the sales tax cases from the TiNY Blog for the week of February 12, 2024.

Sales Tax Cases from the TiNY Blog for February 8, 2024

Here are the sales tax cases from the TiNY Blog for the week of February 8, 2024.

Sales Tax Cases from the TiNY Blog for January 12, 2024

Here are the sales tax cases from the TiNY Blog for the week of January 12, 2024

Sales Tax Cases from the TiNY Blog for January 11, 2024

Here are the sales tax cases from the TiNY Blog for the week of January 11, 2024.

Sales Tax Cases from the TiNY Blog for September 28, 2023

Here are the sales tax cases from the TiNY Blog for the week of September 28, 2023.

Sales Tax Cases from the TiNY Blog for August 25, 2023

Here are the sales tax cases from the TiNY Blog for the week of August 25, 2023.