The renewal period for Highway Use Tax registrations is just around the corner. The Tax Department, ever mindful of the leverage this affords, just sent out a slew of computer-generated notices that inform taxpayers with outstanding tax liabilities that the Department cannot issue them a renewed Certificate of Registration and decals until the liabilities are resolved.

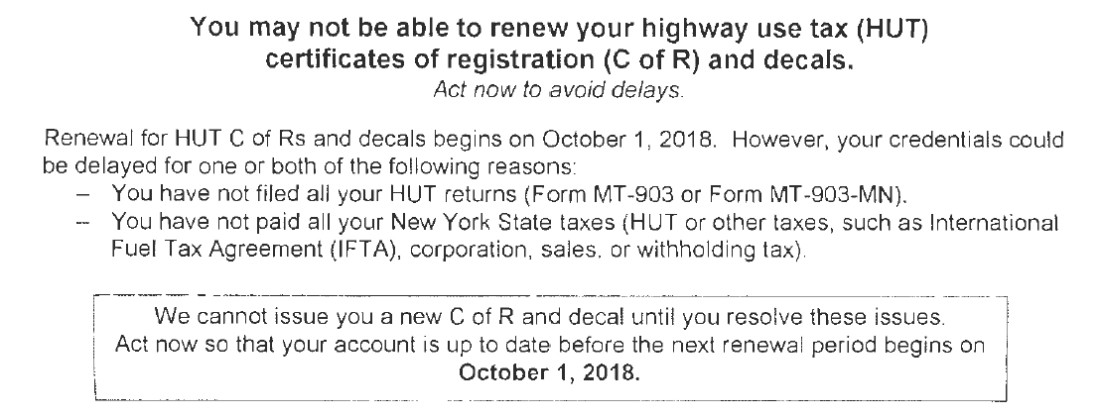

The recent notices—labeled Form TMT-5—look something like this:

Unfortunately it looks like the Department sent out these notices without first culling the recipient list of those who have timely protested their outstanding liabilities. While the Department may be able to withhold registration renewals from taxpayers who have final, outstanding liabilities (i.e., liabilities where the taxpayer’s rights of protest have expired or been exhausted), it cannot withhold a renewal from taxpayers who are currently appealing their assessed liabilities. Thus, the statement “[w]e cannot issue you a new C of R and decal until you resolve these issues” is patently wrong for any taxpayer that has received the notice but protested the assessment(s). We’ve been contacted by several taxpayers who are currently appealing their audit results, but been improperly told by the Department that the Department cannot issue them a renewed Certificate. This is a scary prospect for many businesses. A registration denial could have a massive impact on a business and even threaten its viability.

So if you have received one of these notices and it doesn’t seem right, you should immediately call the number on the notice. To the Department’s credit, we haven’t yet had any problems helping taxpayers, who have timely protested their assessments, complete the renewal process. Of course, one wonders, have any taxpayers chosen not to appeal their assessments, or to abandon an appeal, in order to resolve the registration renewal due to the notice’s incorrect information?