About This Blog

Sales tax is one of the most interesting, and challenging, taxes. It’s interesting because it involves clients in every possible industry. Every active business has potential sales tax exposure, no exceptions! And unfortunately sales tax compliance is particularly difficult for two, specific reasons. First, the tax is perhaps the most fact-dependent – seemingly inconsequential changes in the underlying facts can transform a nontaxable sale into a taxable one. Second, these rules are constantly changing. It’s tough enough to keep up with these changes in just one state. But many vendors, especially those selling over the internet, have to keep abreast of these changes in multiple states. So it’s easy to fall behind on sales tax compliance.

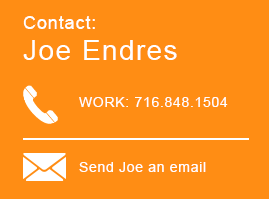

With this blog, we hope to keep you up to date on impactful changes in the sales tax compliance, especially in New York State. We’ll review legislative and administrative changes in the sales tax; we’ll discuss new sales tax case law; and we’ll highlight the enforcement initiatives and tactics we’re seeing while defending businesses in sales tax audits. We hope you find this content as interesting as we do. Please contact us with any questions.

Stay Connected

Topics

Sales Tax Cases from the TiNY Blog for February 12, 2024

Here are the sales tax cases from the TiNY Blog for the week of February 12, 2024.

ALJ Order

Matter of Noranjo (ALJ Baldwin, February 1, 2024); Div’s Rep. Adam Roberts, Esq.; Pet’s Rep. pro se; Articles 22, 28 and 29.

Apparently, Petitioner was not very good at filing and paying taxes for the businesses he owned, and maybe some other aspects of life.

The Division issued a Notices and Demand numbers L-*****9237 on November 23, 2010, and L-*****4193 on March 22, 2013. Judge Baldwin determined that the DTA did not have jurisdiction to adjudicate the validity of those notices because the DTA’s jurisdiction is limited to addressing Notices of Deficiency and Notices of Determination. Since the DTA did not have jurisdiction over Notices and Demand, the Judge dismissed those claims.

The Division’s records also indicated that it had issued nine Notices of Deficiency for tax periods ranging from 2010 to 2014. These notices were due to the Division’s determination that Petitioner was a responsible office who willfully refrained from remitting income taxes for the employees of a few different businesses. And the Division issued two Notices of Estimated Determination for sales taxes. It may have been difficult for Petitioner to have been a de facto responsible officer for some of the later periods since he was in federal prison for six-plus years beginning March 14, 2013.

The Judge found that the Division proved its standard processes for mailing and that those processes were followed by the Division with respect to six of the Notices sent to Petitioner, and since the request for Conciliation Conference with respect to those notices was filed long after the 90-day deadline had passed, Judge Baldwin granted summary judgement in favor of the Division for those Notices.

However, strikeouts appearing in the certified mailing records (CMRs) used to record the mailing of five of the Notices were not explained to the satisfaction of the Judge, so the Judge ordered that the parties adjudicate the merits of those Notices in a formal hearing. The strikeouts related to notices that were “pulled” from the batch prior to actual mailing.

And then there was this conclusion of law: “Petitioner’s argument that he did not receive the notices because he was incarcerated when some of the notices were issued is of no avail. The 90-day period of limitations is not tolled for a period of incarceration.”

Ouch.