About This Blog

Sales tax is one of the most interesting, and challenging, taxes. It’s interesting because it involves clients in every possible industry. Every active business has potential sales tax exposure, no exceptions! And unfortunately sales tax compliance is particularly difficult for two, specific reasons. First, the tax is perhaps the most fact-dependent – seemingly inconsequential changes in the underlying facts can transform a nontaxable sale into a taxable one. Second, these rules are constantly changing. It’s tough enough to keep up with these changes in just one state. But many vendors, especially those selling over the internet, have to keep abreast of these changes in multiple states. So it’s easy to fall behind on sales tax compliance.

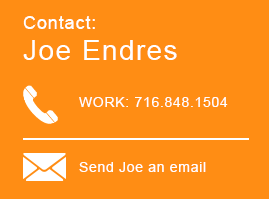

With this blog, we hope to keep you up to date on impactful changes in the sales tax compliance, especially in New York State. We’ll review legislative and administrative changes in the sales tax; we’ll discuss new sales tax case law; and we’ll highlight the enforcement initiatives and tactics we’re seeing while defending businesses in sales tax audits. We hope you find this content as interesting as we do. Please contact us with any questions.

Stay Connected

Topics

Sales Tax Cases from the TiNY Blog for February 8, 2024

Here are the sales tax cases from the TiNY Blog for the week of February 8, 2024.

Orders

Matter of Carlo Seneca (ALJ Behuniak, January 18, 2024); Div’s Rep. Melanie Spaulding, Esq.; Pet’s Rep. Scott Ahroni, Esq.; Articles 28 and 29.

The Judge denied Petitioner’s motion to re-open the record and to reargue the case after a determination had been issued. Petitioner argued he was not a responsible officer of the underlying business at the original hearing. But after he didn’t prevail in that hearing, he dug deep and found a copy of an amended operating agreement that, maybe, showed he was not a responsible officer.

The Judge was having none of it. ALJ determinations are the only opportunity for litigants to establish the factual record for the case, and absent extraordinary circumstances, once the record is closed, it’s closed. And it’s even harder to re-open the record after a determination has been issued. One of the few grounds for re-opening the record post-determination is new evidence which: (1) if introduced into the record, would probably have produced a different result, and (2) which could not have been discovered with the exercise of reasonable diligence in time for introduction at the hearing.

Judge Behuniak found that Petitioner did not establish that the amended operating agreement could not have been found in time for the hearing with the exercise of reasonable diligence. In support of his ruling denying the motion, the Judge noted that Petitioner did not establish in his motion what actions were taken to find the agreement before the hearing had ended, and why the actions that eventually un-earthed the agreement after the determination was made were in excess of what normally would be viewed as reasonable diligence.

Matter of Anthony Piacquadio (ALJ Behuniak, January 18, 2024); Div’s Rep. Melanie Spaulding, Esq.; Pet’s Rep. Scott Ahroni, Esq.; Articles 28 and 29.

This is similar to Matter of Seneca, with a similar result. The Judge denied Petitioner’s motion to re-open the record and to reargue the case after a determination had been issued. Petitioner argued he was not a responsible officer of the underlying business at the original hearing. But after he didn’t prevail in that hearing, he dug deep and found a copy of an amended operating agreement that, maybe, showed he was not a responsible officer.

The Judge was having none of it. ALJ determinations are when the litigants are permitted to establish the factual record for the case, and absent extraordinary circumstances, once the record is closed, it’s closed. And it’s even harder to re-open the record after a determination has been issued. One of the few grounds for re-opening the record is new evidence which: (1) if introduced into the record, would probably have produced a different result, and (2) which could not have been discovered with the exercise of reasonable diligence in time for introduction at the hearing.

Judge Behuniak found that Petitioner did not establish that the amended operating agreement could not have been found in time for the hearing with the exercise of reasonable diligence. In support of his ruling denying the motion, the Judge noted that Petitioner did not establish in his motion what actions were taken to find the agreement before the hearing had ended, and why the actions that eventually un-earthed the agreement after the determination was made were in excess of what normally would be viewed as reasonable diligence.

In addition, Judge Behuniak found that the agreement would not have been conclusive proof that Petitioner was not a member of the LLC that operated the underlying business. Accordingly, the introduction of the agreement probably would not have produced a different result.