About This Blog

Sales tax is one of the most interesting, and challenging, taxes. It’s interesting because it involves clients in every possible industry. Every active business has potential sales tax exposure, no exceptions! And unfortunately sales tax compliance is particularly difficult for two, specific reasons. First, the tax is perhaps the most fact-dependent – seemingly inconsequential changes in the underlying facts can transform a nontaxable sale into a taxable one. Second, these rules are constantly changing. It’s tough enough to keep up with these changes in just one state. But many vendors, especially those selling over the internet, have to keep abreast of these changes in multiple states. So it’s easy to fall behind on sales tax compliance.

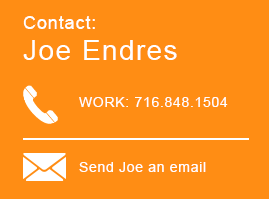

With this blog, we hope to keep you up to date on impactful changes in the sales tax compliance, especially in New York State. We’ll review legislative and administrative changes in the sales tax; we’ll discuss new sales tax case law; and we’ll highlight the enforcement initiatives and tactics we’re seeing while defending businesses in sales tax audits. We hope you find this content as interesting as we do. Please contact us with any questions.

Stay Connected

Topics

Ariele R. Doolittle

Ariele R. Doolittle

Showing 1 post by Ariele R. Doolittle.

Updated Guidance Issued on Responsible Person Relief Under the Sales Tax Law

The New York State Tax Department released new guidance last week in TSB-M-20(2)S addressing potential avenues for relief for those assessed as responsible persons for sales tax. This new TSB-M largely mirrors amendments to Tax Law § 1133(a) that were enacted as part of the budget legislation for fiscal 2018-2019 which we covered here and here. That legislation established statutory relief for certain limited partners and LLC members who were assessed and held jointly and severally liable for sales tax assessments solely by virtue of their interest in a partnership or LLC. To qualify for relief, eligible limited partners and LLC members must principally show that: (i) they were not under a duty to act for the LLC or partnership in complying with the requirements of the sales tax; and (ii) their ownership interest and the percentage of their distributive share of the profits and losses of the LLC or partnership are each less than 50%.